The Panopticon of Equity Markets

Why is the U.S. locked out of single stock futures? And why are perps the way forward?

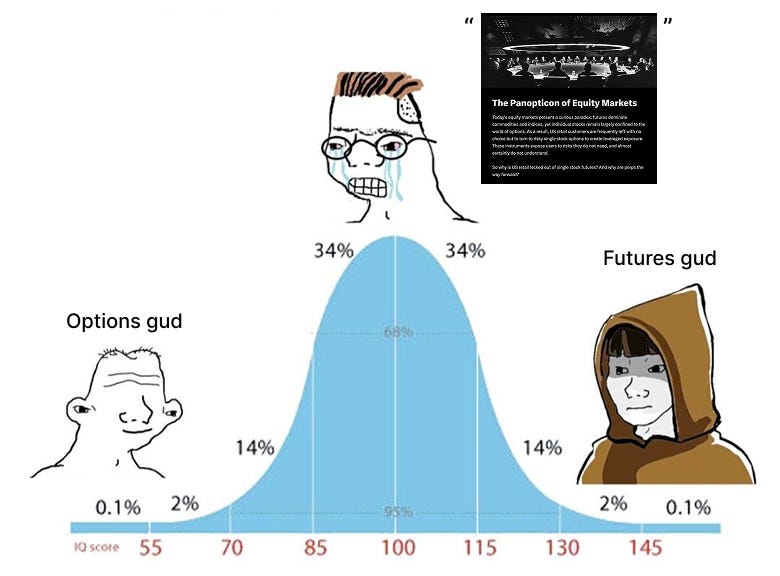

Today's equity derivatives markets present a curious paradox: futures dominate commodities and indices, yet individual stocks remain largely confined to the world of options. U.S. equity traders, for example, are left with no choice but to turn to risky single stock options to create leveraged exposure. These instruments expose users to risks they do not need, and for the vast majority, do not understand.

The Great Divide

Futures contracts have become the dominant force across most asset classes. In commodities, oil futures trade around 50 times the volume of physical oil. Interest rate derivatives overshadow the underlying bond markets by 4:1, with $579 trillion in notional value. Currency futures and forwards represent the backbone of international trade and investment.

The absence of futures in U.S. equities, meanwhile, is something of a historical accident: when futures markets developed in the 19th and early 20th centuries, they focused on commodities and agricultural products. By the time financial futures emerged in the 1970s, regulatory boundaries had already been established. Stocks fell under SEC jurisdiction as securities, while futures remained with the CFTC.

As a consequence of this dual regulatory mandate, equity derivatives in the U.S. were forced under the options framework. The gap in the market - of viable futures on single stocks - persists to this day.

The Hidden Cost of Options Complexity

The dominance of options in U.S. equity markets creates significant inefficiencies that most traders don't fully appreciate. While options serve important purposes for sophisticated strategies, the vast majority of equity options volume represents something much simpler: traders seeking leveraged exposure to stock price movements.

Consider the typical retail trader buying call options on a popular stock.

They're not implementing complex volatility strategies or seeking asymmetric payoffs. They don’t care, or likely even know about, the additional risks that trading options poses (the ‘Greeks’ - theta, vega, gamma, rho etc). They simply want to amplify their returns with limited capital. Retail users are forced into an options framework that introduces unnecessary complexity and costs.

Options markets also suffer from liquidity fragmentation. A stock trading at $100 might have active options at strikes $90, $95, $100, $105, $110, and beyond, each over multiple expiries. Each strike represents a separate market with its own bid-ask spread and liquidity profile; S&P500 options have around 2000 associated order books. But market makers have capital and risk limits, that they now have to spread across the liquidity landscape; the result is wider spreads and higher trading costs. Futures, meanwhile, typically only have one active order book at a time.

The Pricing Uncertainty Problem

Options present market makers with fundamental challenges that don't exist with futures, including complex Greeks calculations and future volatility estimates.

Futures pricing, by contrast, is far more straightforward. Futures strategies can be left to fully automated systems that quote tight spreads and require minimal human effort to run. Human options traders, meanwhile, demand higher transaction costs for their intensive labour. And no wonder - Fischer Black and Myron Scholes were awarded the Nobel Prize for Economics for working out the fair price of an option, but you don’t need a Nobel Prize to understand how to price a future!

The complexity also creates barriers to entry.

Futures are intuitive. If you think a stock will rise, you buy a future and profit from the increase. Options require understanding of strike prices, expiration dates, implied volatility, and time decay. This complexity keeps many potential participants out of the market.

The Perpetual Solution

Cryptocurrency markets have pioneered the next evolution: perpetual futures.

For equity markets, perpetual futures represent an opportunity to provide what most options traders actually want: simple, efficient leverage. Instead of choosing between dozens of strike prices and expiration dates, traders can access direct exposure to stock price movements with transparent pricing and concentrated liquidity.

The benefits extend beyond simple leverage.

Institutional investors managing large portfolios can hedge more efficiently with equity perps, avoiding the cost of rolling their futures monthly or quarterly. And this isn't a new idea: swaps, an off-exchange version of perps, already trade massive sizes on Swap Execution Facilities in the United States. By bringing the swaps market on-exchange, perps greatly benefit the end user with increased liquidity and price transparency.

The Path Forward

The technology exists. The demand is proven in crypto. The only barrier is regulatory inertia that protects an inefficient status quo. As markets evolve toward greater efficiency, the artificial separation between equity options and futures becomes increasingly untenable.

Perpetual futures on equities would provide what markets need most: instruments that allow participants to express their views efficiently, without unnecessary complexity. In a world where leverage has become the dominant force across all asset classes, equity markets remain trapped by an options framework designed for a bygone era.

The question isn't if equity futures will eventually emerge - it's when.

For traders forced to navigate the complexity and costs of options when they simply want leveraged equity exposure, change can't come soon enough.