Leverage, Rebalancing and the Short Gamma Problem

For retail, there aren't many ways to trade equities with simple (no options) leverage.

Some brokers offer inbuilt margin loan functionality, but this is restricted and complex. Most tax wrappers - like 401(k)'s in the US, or ISAs in the UK - won't let you use margin, either.

Enter Leveraged ETFs.

They promise simple exposure: 2x the daily return of the S&P 500, 3x the movement of gold miners, or -1x the performance of Tesla. Their marketing is straightforward, but performance is almost always underwhelming. The mechanics create a hidden tax that compounds over time.

These instruments suffer from what options traders call the 'short gamma problem': they're forced to buy high and sell low to achieve daily rebalancing. This process systematically destroys value.

Perpetual futures offer the same leveraged exposure without forcing this daily structural flaw. Let's examine the mathematics of rebalancing, and the path-dependent nature of compound returns, to unveil why.

The Rebalancing Trap

Leveraged ETFs must maintain their target leverage through daily rebalancing. For example, a 2x leveraged S&P 500 ETF (like SSO 0.00%↑ ) must maintain exactly 2x exposure to the S&P 500 at the end of each trading day. When the market moves, this creates a mechanical trading requirement that often works against the fund.

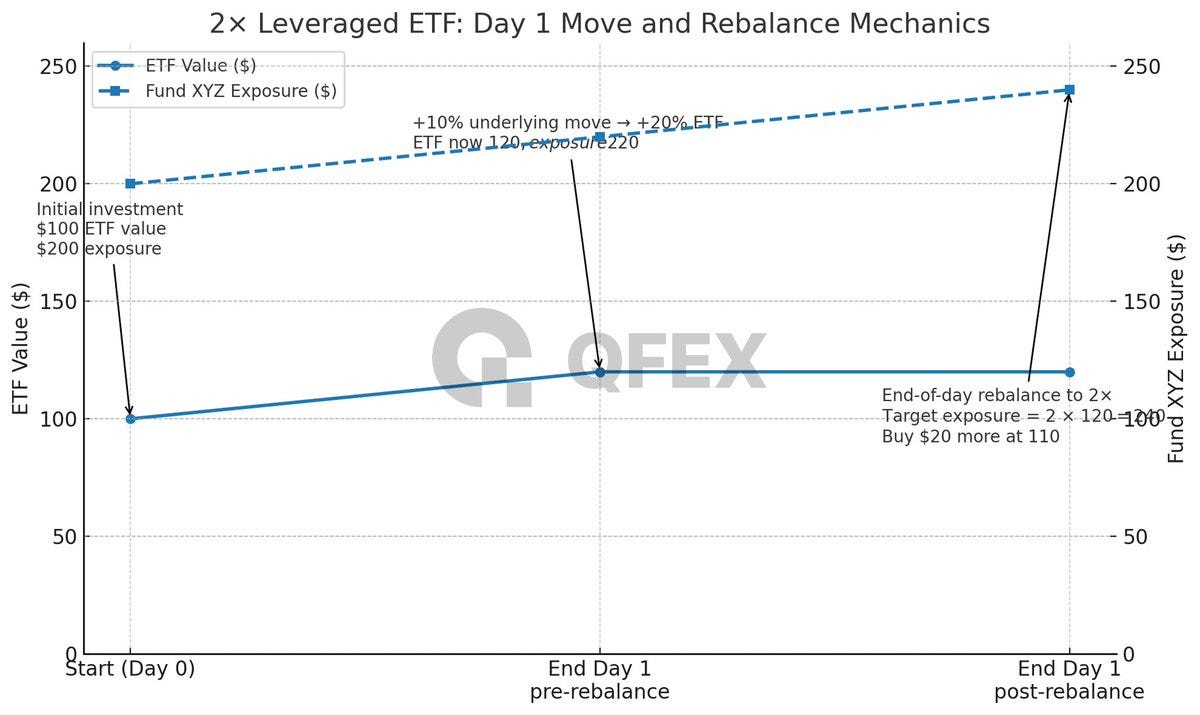

Here's an example: I invest $100 in a 2x leveraged ETF when the underlying index $XYZ is at $100. The fund buys $200 of $XYZ exposure.

Day 1: $XYZ rises 10% to $110

My ETF gains 20%, so it’s now worth $120

The fund's $XYZ exposure increases to $220 (a 10% increase on $200)

But to maintain 2x leverage at the end of the day, it needs $240 of exposure (2x my $120 ETF position)

Required trades: Buy $20 more $XYZ exposure at $110

The fund now has $240 exposure, which is double my ETF position of $120. It has rebalanced.

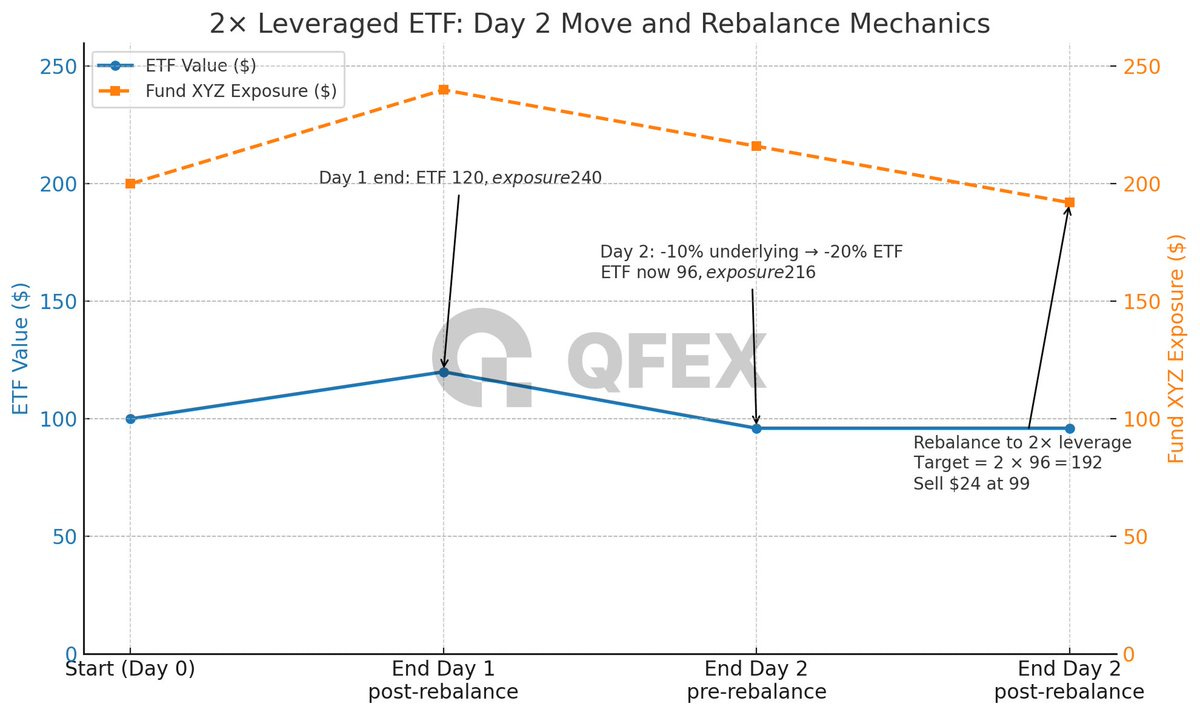

Day 2: $XYZ falls 10% from $110 back to $99 (a fall of $11)

Fund’s starting exposure: $240 (from end of Day 1)

Fund’s exposure after 10% decline: $216 (a fall of $24)

My ETF loses 20%, so it’s now worth $96

To maintain 2x leverage, the fund needs an exposure of $192

Required trades: Sell $24 of index exposure at $99 to rebalance.

So in order to keep the required amount of leverage each day, the fund bought $20 at the high ($110) and sold $24 at the low ($99).

The underlying index ended at $99 (down 1%), so one might expect my position to be down 2% (worth $98).

In fact, it’s worth $96. I’ve lost $2 from buying high and selling low as the fund rebalanced to maintain my leverage. This is the ‘short gamma problem' of leveraged ETFs. The more volatile the underlying asset and the more frequently I rebalance, the more money I lose.

The Gold Miners Debacle

The gold mining sector provides a perfect case study in leveraged ETF destruction of value. The three key indexes for this study are:

GDX 0.00%↑ (VanEck Gold Miners ETF): The underlying index

NUGT 0.00%↑ (Direxion Daily Gold Miners Bull 3X): 3x leveraged long

DUST 0.00%↑ (Direxion Daily Gold Miners Bear 3X): 3x leveraged short

Over a volatile 7-trading-day period in March 2020 (during the COVID pandemic), GDX was virtually unchanged (-0.2%). However, both NUGT and DUST lost over 5% in value. The daily rebalancing in a volatile, up-and-down market systematically destroyed value in both long and short directions.

Traders here might think something is fishy - and they'd be right. There's an opportunity here in predicting the fund's rebalancing trades in the underlying index. I'll defer to the legendary Kris Abdelmessih’s article to explain this properly.

Even Direxion (the ETF providers) themselves caution investors that the NUGT and DUST funds “should not be expected to provide three times or negative three times the return of the benchmark’s cumulative return for periods greater than a day.” In other words, leveraged ETFs track the move of the underlying each day; over periods of more than a day, they systematically eat away at returns.

Perpetual Futures Are Better

Perpetual futures eliminate the daily rebalancing problem. Users seeking long-term leveraged exposure to equities could rebalance their leverage far less frequently, reducing the effective volatility by allowing the underlier time more time to increase in value and negating this short gamma problem.

To put it in concrete terms, if I buy exposure to the S&P 500, there's a 50% chance it is lower tomorrow. If I wait a year, that drops to 25%, using average S&P 500 performance over the last 100 years (it's even lower if I just use the last 20 years).

By rebalancing yearly, I make buying low and selling high during my rebalance far, far less likely.

The choice is clear: accept the gamma tax of leveraged ETFs, or embrace the clean leverage of perpetual futures.