Boring Bitcoin

Here's why you should stop trading $BTC as a proxy, and start trading the underlying equities themselves.

The Correlation Reality Check

Bitcoin is now a digital Nasdaq 100.

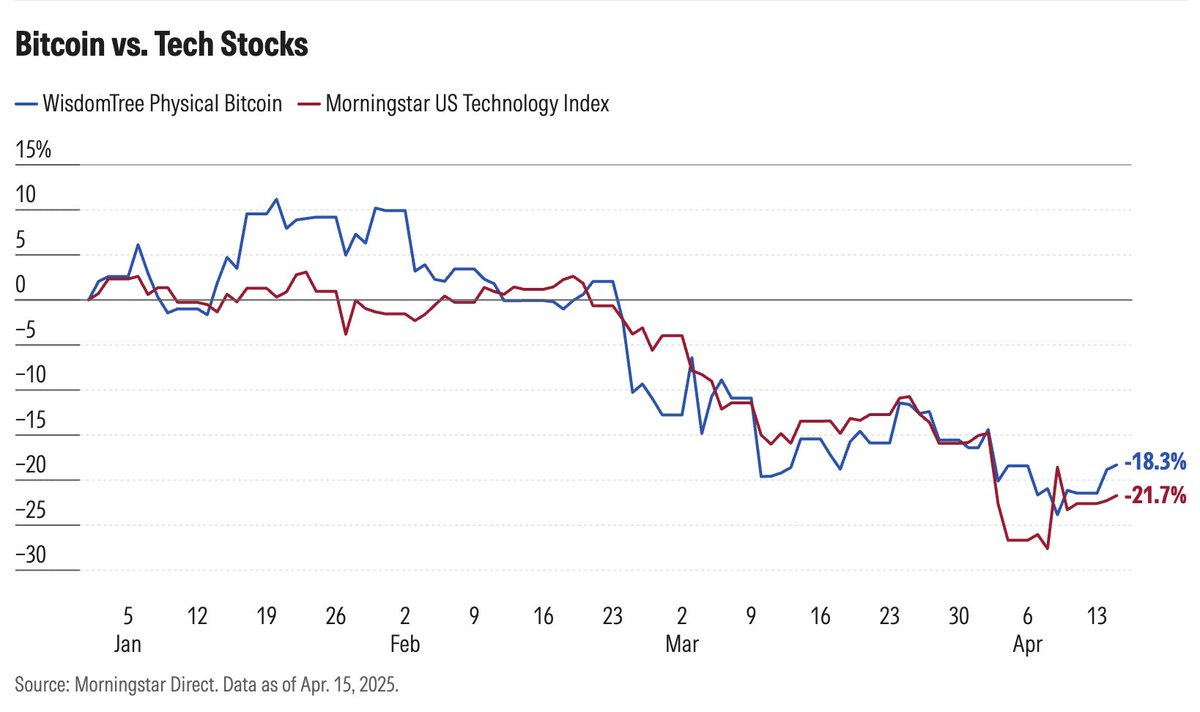

The data reveals everything you need to know: $BTC’s 90-day correlation with the Nasdaq hits 0.85+ during major market moves. When Trump announced tariffs in April 2025, $BTC fell 10.5% while the Nasdaq dropped 11.6% and the S&P 500 lost 12%.

$BTC has become a proxy tech stock basket that trades 24/7.

So why not just trade the real thing?

Bitcoin Is Getting Boring

Unsurprisingly for a digital version of the Nasdaq, $BTC is becoming less volatile. 90-day annualized volatility has dropped from ~95% in March 2021 to ~35%, implied vol currently at a ~60% reduction.

Meanwhile, individual tech stocks are still delivering the volatility crypto traders crave - TSLA 0.00%↑ and NVDA 0.00%↑ have annualized vols higher than $BTC!

$BTC makes no sense any more: it’s trading a "volatile" asset that's less volatile than the individual stocks it's correlated with.

The Tarpit of Tokenized Equities

Before we talk about the right solution, let's address the wrong one: tokenized equities.

Tokenized equities promised to bridge crypto and traditional finance. The reality has been a liquidity graveyard.

Platforms like FTX (before its bankruptcy), Binance (discontinued), and Mirror Protocol (Terra implosion) all tried.

Why Perps are Perfect

Here's something crypto traders intuitively understand but traditional equity traders miss: leverage makes less volatile assets just as interesting as more volatile ones.

A 2X leveraged position in AAPL 0.00%↑ (historical volatility ~25%) provides similar risk characteristics to an unlevered position in $BTC.

But the AAPL 0.00%↑ trade opens up a world of new angles for trading: earnings, product launches and even weird glass sculptures given to President Trump, rather than crypto news alone.

And what better way for crypto traders to do the above trade, but with perps.

Let's recap why crypto users fell in love with perps in the first place:

No Expiration: Trad futures expire monthly or quarterly. Perps stay open indefinitely. No rolling, no expiry date concerns, no time decay; you can hold a position for years, if your conviction is strong.

Liquidity Concentration: Trad futures fragment liquidity across multiple expiry dates (March, June, September, December) contracts all trading simultaneously. Perps consolidate all trading into a single contract, creating deeper order books and tighter spreads.

24/7 Access and High Leverage: The modern architecture of perps exchanges allow for 24/7 liquidity and high leverage, which fuels crypto native degeneracy.

Equities are the New Bitcoin

If you're trading $BTC because you have a view on TSLA 0.00%↑...

You're doing it wrong.

If you're trading $BTC because you think the Nasdaq is overvalued...

You're doing it wrong.

If you're trading $BTC because you want to express macro views on the US economy...

You’re definitely doing it wrong.

Equity perps will give you everything you love about crypto trading: 24/7 access, high leverage, and perpetual contracts - applied to assets with real fundamentals, deeper liquidity, and clearer catalysts.

Stop betting on the proxy. Trade the real thing.